Indian Wedding Market: Not A Billion It’s A Trillion Dollar Opportunity

Before we dive into the industry stats and learn about its estimated growth; the Below numbers give you a glance at what you are surrounded with, if you are planning to visit anyone’s wedding in the coming months.

32 lakhs+ weddings in 3 months period(Nov 22 — Feb 23) and estimated a whopping spent of 3.75 lakh crores. This isn’t the Indian wedding market for you. There’s more!

Are you just thinking that’s a lot of money? But that’s how Indian weddings are planned right?

Grand. Lavish. Sumptuous.

32 lakhs+ weddings aren’t sounding like it’s only because of postponing many weddings during covid? Yes, even I have relatives who planned for a wedding in 2020 and couldn’t due to covid restrictions.

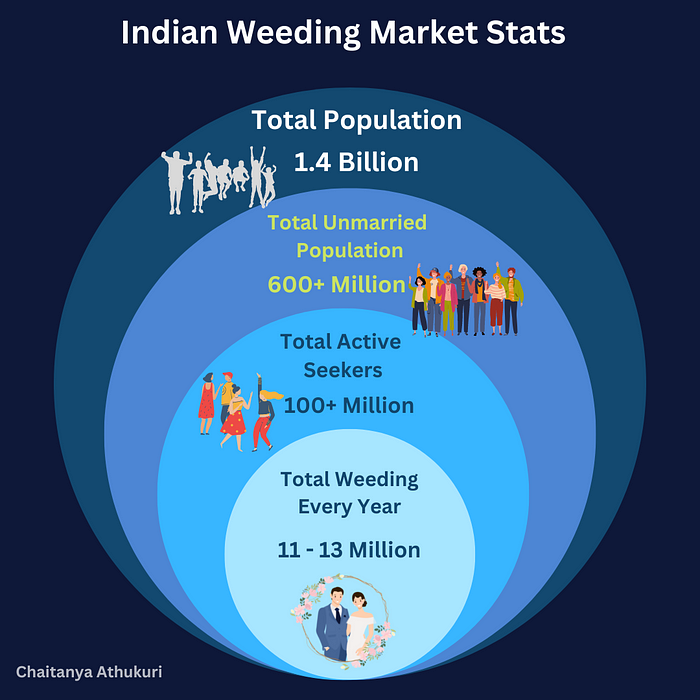

But would you believe it If I say there are 60M+ active wedding seekers in the country and even if 20% succeed 11–13 Million+ weddings will be seen in India every year?

34% of India’s population is between the ages of 20–39, and close to 10% is between the ages of 15–19, who will join the marriage-appropriate demographic age group in the next five years. I think it’s safe to say that the Indian industry is set to grow in the near future.

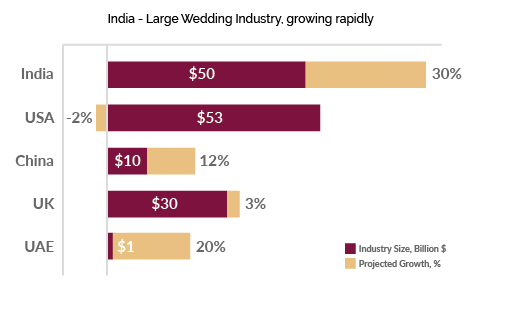

Indians spend about $130 billion annually on weddings, making the industry the fourth largest industry in the country, just behind energy, banking, and insurance as per reports by The Economist.

According to Weddingwishlist.com, India is estimated to have about 40 crore weddings in the next 15 years, while the total population of the USA is 32 crore. The per capita expenses in India are about 1/10th of America. Yet, the per capita wedding spend in urban India is 1.5 times the latter.

The current leader in terms of industry size is the US but it is actually witnessing a negative growth rate, whereas India is by far the highest in terms of projected growth in the wedding market.

I’m not sure how crazy you are about wedding spending but here is the economics of most people that are backing the industry and making the industry the 4th largest in the country

20% of life income — is typically spent on Indian wedding

20% of all loans — taken in India are for the wedding

80% of Indians — take a loan to meet wedding expenses (Private or Public)

62% of weddings — are low expense with spent of 1–2 lakhs in rural India (Yes, the market is backed by the middle class and above target segment)

70% of weddings — have average spending of 6 lakhs to 1 Crore in India.

“The big fat Indian wedding has evolved and while people are spending more or less the same amount, the guest list size has significantly come down. From 400–500 guests on an average pre-Covid, it has now come down to 200–250. But the spending has not reduced as couples are focusing on enhancing the guest experience,” quoted Anam Zubair, head of marketing, WeddingWire.

The wedding market isn’t a single industry that holds the whole bag, but many big and small industries that make it what it is combined; right from weeding matchmakers to post-marriage visiting designations. On the same road, Unarguably we have 3 main industries which drive the most revenue to the wedding market.

Matrimony:

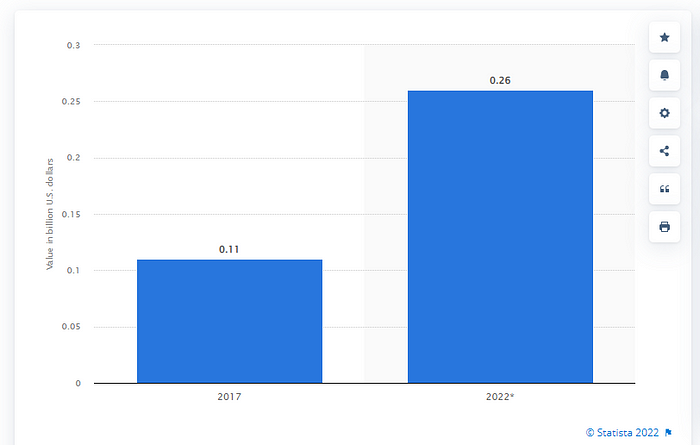

Online Matrimonial sites have also gained traction in the last few years. And its services have grown by 130% year over year while dating sites have increased by 88% which is making it stand by a market share of 12%. In a country where most of the matches are made through relatives, the Internet allows India’s urban youth to connect and communicate via dating/ matrimony apps without any concern, and this industry is expected to grow at a very high rate from 12%.

Few companies winning an opportunity: Matrimony.com, Shaadi, Jodi, SimplyMarry, Wmmatrimonial

Apparels:

Wedding apparel is a big market with all the ethnic vibes and no introduction is needed for the spending as it’s one of the biggest expenses during the marriage right from hiring designers to buying pairs of clothes for the whole family and relatives.

According to Technopak, the total Indian ethnic wear market is valued at Rs 70,000 crore; women’s ethnic wear has an 85 percent (Rs 59,500 crore) share in the market and is expected to grow at a CAGR of 15–17% between 2022–2025. In the industry close to 85% of the market is dominated by unorganized players, while brands and designer labels have a 15% market share.

Companies & designers dominating in this category:

Men’s: Manyavar, Swayamvar, Ethnix, and many more

Women: Nalli, Sabyasachi, Neeru’s and many more

Hotels & Banquet Halls: (Need to rewrite)

Without a lavish hotel or banquet hall, a wedding wouldn’t be complete. The pandemic last year crippled Indian hotels, but now that restrictions have been lifted and weddings have begun in full swing, they are experiencing a revenue boom.

During the wedding season, the India-wide average daily rate (ADR) for hotels and banquets operates at a premium price of 43–45%, helping them to maintain profit margins even during the dry seasons.

Popular companies in this space:

Ferns N Petals, which owns and operates 11 large wedding venues around Delhi NCR, is expecting 100 percent growth in 2022.

Now, I hope we both are on the same page that the wedding Industry in India is huge and it is only bound to grow in the coming years because of our demographic profile.

If you are planning to enter the industry, make sure you checkmark these 3 points

Traditional / Religion: There are weddings and then there are Indian weddings, and it makes a lot of a difference when you get to be a part of them.

Every Indian wedding reflects the culture of the country, which means, attending a wedding in India is like exploring a part of the country; irrespective of the religion and state.

When targeting these folks, Prefer always to place your service and product balancing to every religion and a bit more customizable to the seasonal prices and embellishments.

Prestigious: In India, most wedding expenses are not needs, they mostly are “want” category. As Kunal shah says, people try to make living halls look expensive (to look great for visitors) in the house even if they sleep on the ground in the bedroom. Most people’s mindset is always behind what others(relatives and friends) think and talks about them.

Sell that premium and unique service you have so that they can boast about your exclusive product or service at their weddings.

Patience: The wedding Target audience is a little tricky, they will select the service/product after comparing with many others in the market or preferably recommended by relatives. Try to maintain a competitive advantage over other players in the industry.

Yes, Word of mouth does the magic here!

Bottom line: Indian wedding isn’t just welcoming a partner and starting a new life by the bride and groom but also a celebration of Joy for the hundreds of friends and relatives.

When it’s said Joy, it’s mostly a “wants” category which means that’s a target segment and market time where money flows without many restrictions as India sees it as once-in-lifetime spending.

Follow Chaitanya Athukuri to not miss any interesting reads.

Research Source: Medium, Statista, Global trends, and more on google

Reads to understand deeply about the market:

Industry Stats: https://www.weddingwishlist.com/wedding-board/indian-wedding-industry-whitepaper/

http://indpaedia.com/ind/index.php/Marriage_statistics:_India